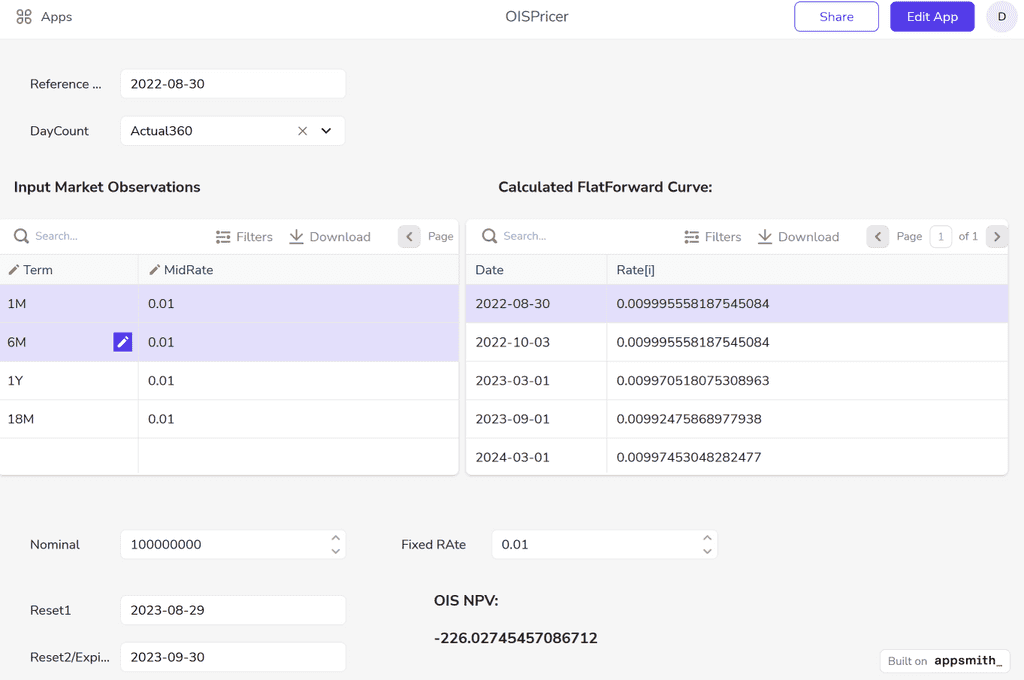

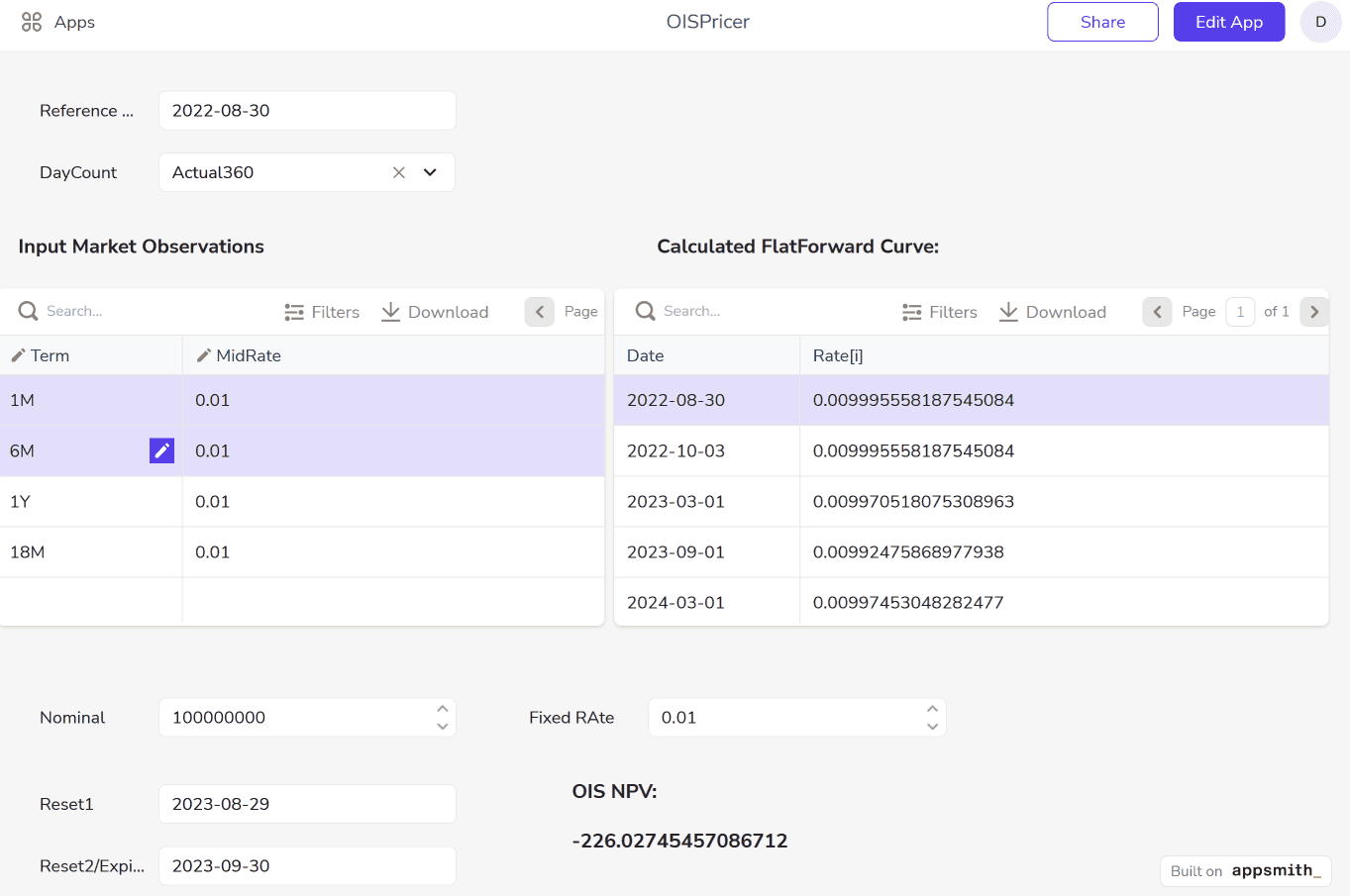

A little demonstration of using Quant API REST Calls to value an Overnight Index Swaps in AppSmith. The whole application can be build in ~15 minutes!

This is how to do it:

- Construct the data for building the yield curve by:

{{

Table1.tableData.map( r => {return {"tenor" : r.Term, "rate" : r.MidRate, "settleDays": 2, "index" : "Sofr"}})

}}- Table with input market data are created by:

[

{

"Term": "1M",

"MidRate": 0.01

},

{

"Term": "6M",

"MidRate": 0.01

},

{

"Term": "1Y",

"MidRate": 0.01

},

{

"Term": "18M",

"MidRate": 0.01

}

]- The build Yield Curve can be presented as:

{{YC.data.dates.map( function (r,i) { return { "Date": r, "Rate": YC.data.rates[i]} } ) }}- Construct the call to OIS pricer with:

{{ { "swap" : { "startDate" : RefDate.formattedDate,

"notional": Input1.text,

"fixedRate": Input2.text,

"index" : "Sofr",

"schedule" : { "dates" : [DatePicker1.formattedDate, DatePicer2.formattedDate]},

"fixedDC" : DayCount.selectedOptionValue},

"curve": YC.data

}

}}- Day counts are defined in the selection box, e.g.:

[

{

"label": "Actual360",

"value": "Actual360"

},

{

"label": "Actual365Fixe",

"value": "Actual365Fixe"

}

]Here is what it looks like: